This is the largest upgrade since Dencun which went live 420 days ago today, and these changes will improve the way that Ethereum handles data posted from L2s, along with other changes included in the upgrade.

The Pectra upgrade introduces two key changes for L2s using Ethereum for Data Availability. It increases blob throughput and introduces higher costs for call data. We take a look at Ethereum blob usage since Dencun (EIP-4844) to get a sense for how the Pectra upgrade is likely to impact the blob market.

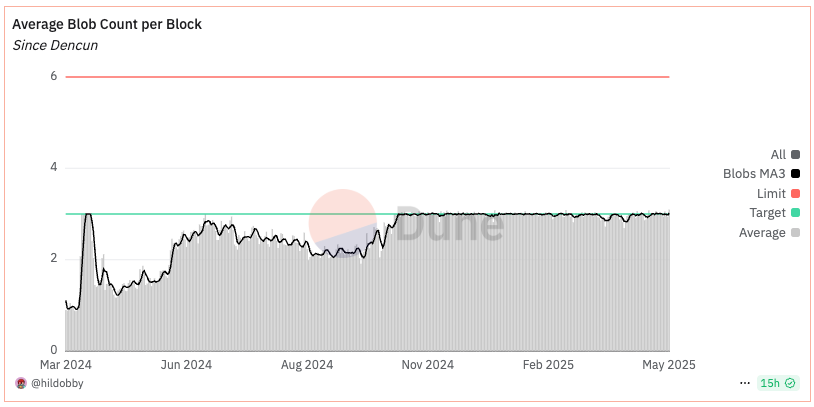

Blob Capacity Utilization

Since November 2024, blobs have been hovering around the 3 blobs per block target (100% utilization). Although the upper limit was 6, when more than 3 blobs are submitted, the price for submitting a blob rises, in the same way that fees rise on Ethereum under peak loads. This is designed to help maintain the target of 3 blobs per block while having extra capacity when required.

With Pectra live, we can expect utilization to increase towards the new target of 6 blobs per block, with the upper limit rising to 9.

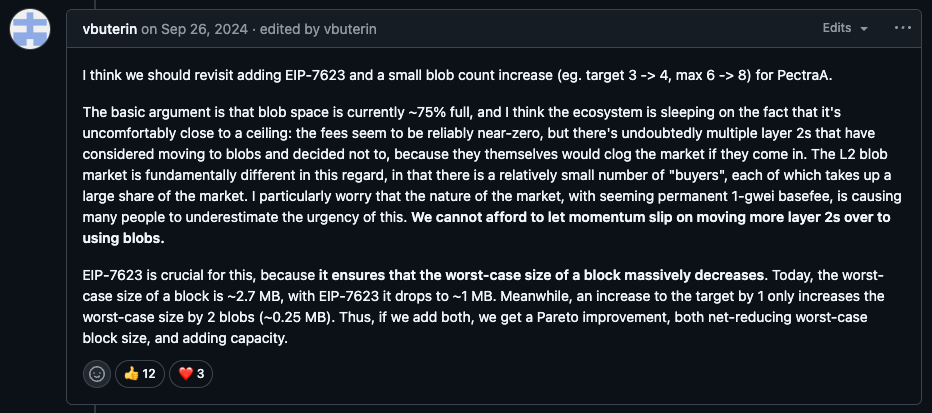

It took around 8 months for Ethereum blobs to reach full utilization after Dencun. Vitalik Buterin warned in September 2024, just 6 months after the Dencun upgrade, that blob space was ~75% full and “uncomfortably close to a ceiling”. He also suggested that there are “undoubtedly multiple layer 2s that have considered moving to blobs and decided not to”, largely because there wouldn’t be enough space for them on Ethereum, with the current capacity.

Blob fees occasionally spiked higher than call data under peak loads. This happened one month after Dencun with the blobscriptions craze, followed by another large blob base fee spike in June with the Arbitrum LayerZero airdrop increasing transaction volume on Arbitrum. On this occasion, L2s overpaid by approximately $550,000 by submitting data as blobs instead of call data.

While L2s can implement strategies like switching to call data when fees rise, slowing down their batch submissions, paying more to have their blobs included, or simply stopping posting data all together until fees stabilize, one fact remains that when demand spikes, L2s still need more capacity.

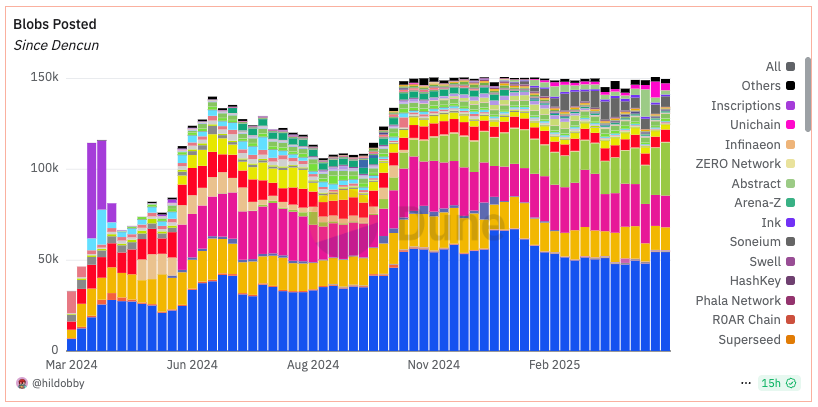

So, Who Is Eating All The Blobs?

The chart below shows the number of blobs being posted per week, broken down by blob submitter (L2s). Note that each line in the chart below represents the amount of blobs posted over a week.

Quick back of the napkin math shows us there were roughly 150k blobs available per week, at the target rate of 3 blobs per block, which has now increased to ~300k per week at the target rate of 6 blobs per block.

~7,150 ethereum blocks per day x 6 blobs per block x 7 days = 300,300 blobs available per week

The Base blockchain has consistently been buying up around one third of the available capacity, consuming around 50-60k blobs per week. Taiko is another large blob consumer, regularly churning through 20-25k blobs per week. Then, both World Chain and Arbitrum have been consuming between 10-20k per week.

Assuming these four L2s don’t start posting more data, their current blob consumption alone will take up around 30-40% of Ethereum’s blob capacity, post Pectra.

What Happens Next?

There’s no denying that introducing rollups significantly improves the Ethereum ecosystem with higher throughput, more teams, more apps and more users. However, everyone is well aware that Pectra is just a temporary solution. For now, these incremental improvements are making the necessary changes to increase throughput and support more rollups, however the market seems ready to eat up all the blobs that Ethereum can produce.

Full Danksharding will provide more capacity improvements again, including the introduction of Data Availability Sampling (DAS), enabling end users to verify Data Availability from edge devices.

Yet, if we were to zoom out a bit, having things like the blobscriptions craze, or a popular airdrop on one L2 leading to disruptions and network congestion on unrelated networks, then we still have a very long way to go to reach the type of throughput required to support a new global financial system. With blockchain based data availability solutions like Avail already providing DA capacity at a fraction of the cost, and with DAS already implemented, it might be a good time to start treating validiums and optimiums that use a blockchain based (and end-user verifiable) DA solution, as first-class citizens.