Around 4 in every 5 countries today are investigating or implementing their own version of a CBDC using blockchain technology, with around 28 countries having either launched or begun implementing a proof-of-concept. The countries pursuing this represent around 90% of global economic output. Only 5 years ago, this trend was in reverse, with 4 in every 5 countries not exploring tokenization at all. This suggests a substantial shift in how blockchain technology and, more broadly, the tokenization of value is being considered among world leaders.

If governments are pursuing tokenization initiatives, then surely private enterprises are too? US based Broadridge, a fintech infrastructure company, processes around $1.5 trillion in transactions monthly in tokenized repurchase agreements. Larry Fink, chairman and CEO of BlackRock, said in January 2024, “We believe the next step going forward will be the tokenization of financial assets, and that means every stock, every bond […] will be on one general ledger.” Now, while there’s still a long way to go before we get there, one thing is abundantly clear, it’s not a question of if, but when and how this tokenization will take place.

Private vs. Public Blockchains

Most, if not all of these institutional projects are built on private blockchains. While this runs counter to the founding decentralization ethos of public blockchain networks like Bitcoin, it’s not surprising that governments and institutions have opted to contain their blockchain experiments and early stage products within private networks.

Parallels are often drawn between the development of public blockchains to the early stages of the internet. Institutions opted first for private intranets, while the internet was a rouge and unruly place. It wasn’t until the technology matured enough, and more customers moved online that the need to remain competitive, began forcing institutions online too.

We are starting to see the signs of a similar transformation taking place today, however this time it’s about moving onchain.

Public Blockchains Simply Aren’t Yet Ready

The tokenization of assets, especially mature capital market, require stability and performance guarantees that can withstand large spikes in demand. Even the most successful public blockchain networks face throughput constraints when launching popular memecoins. Until the infrastructure matures to a point where stability can be guaranteed, it’s likely that developments on private networks will continue to prevail.

That introduces another problem, which is prevalent among public blockchain networks too, and that’s fragmentation. As more public networks develop and more private networks proliferate, fragmentation becomes a more complex problem to solve.

Rollups & Horizontal Scalability

If the adoption of the internet were to shed any light on the adoption of public blockchain infrastructure, it would be this - look at the developments taking place within public networks to see what institutions will likely adopt in a few years time.

While many lessons could be learned, we at Avail believe there are two of particular importance, and these underpin Avail’s core thesis.

- Rollups are key to scaling, and

- A horizontal scalable foundation solves fragmentation

1. Rollups Are Key To Scaling

Facing congestion when executing transactions under peak demand, Ethereum scaled its public blockchain by moving resource heavy transaction execution to rollups. The result - much higher throughput and cheaper transaction fees for users, but with fragmented liquidity and poor user journeys.

Rollups work by posting transaction data to a shared network. In the case of Ethereum, rollups were paying around $1,300-$1,600/MB for this initially, which has now been reduced to a few dollars following the EIP-4844 upgrade. Yet demand for this block space is already mostly full, and being consumed by rollups eager to post their data there.

We believe that more institutions will begin adopting rollup architectures because they are much easier and more efficient to run. Yet with most of Ethereum’s throughput (0.768MB per block) being consumed by rollups already, we find ourselves in the familiar position where public blockchain infrastructure, even with these improvements, is not yet ready for institutional adoption.

Avail launched its public blockchain in 2024 with throughput of 2MB per block for rollups, which has now increased to 4MB per block on mainnet, with 16MB tested. We believe that having public infrastructure that can support institutional demand spikes requires higher throughput still, which is why we have shown a path to achieving 10GB per block for rollups, with 0.6sec block times.

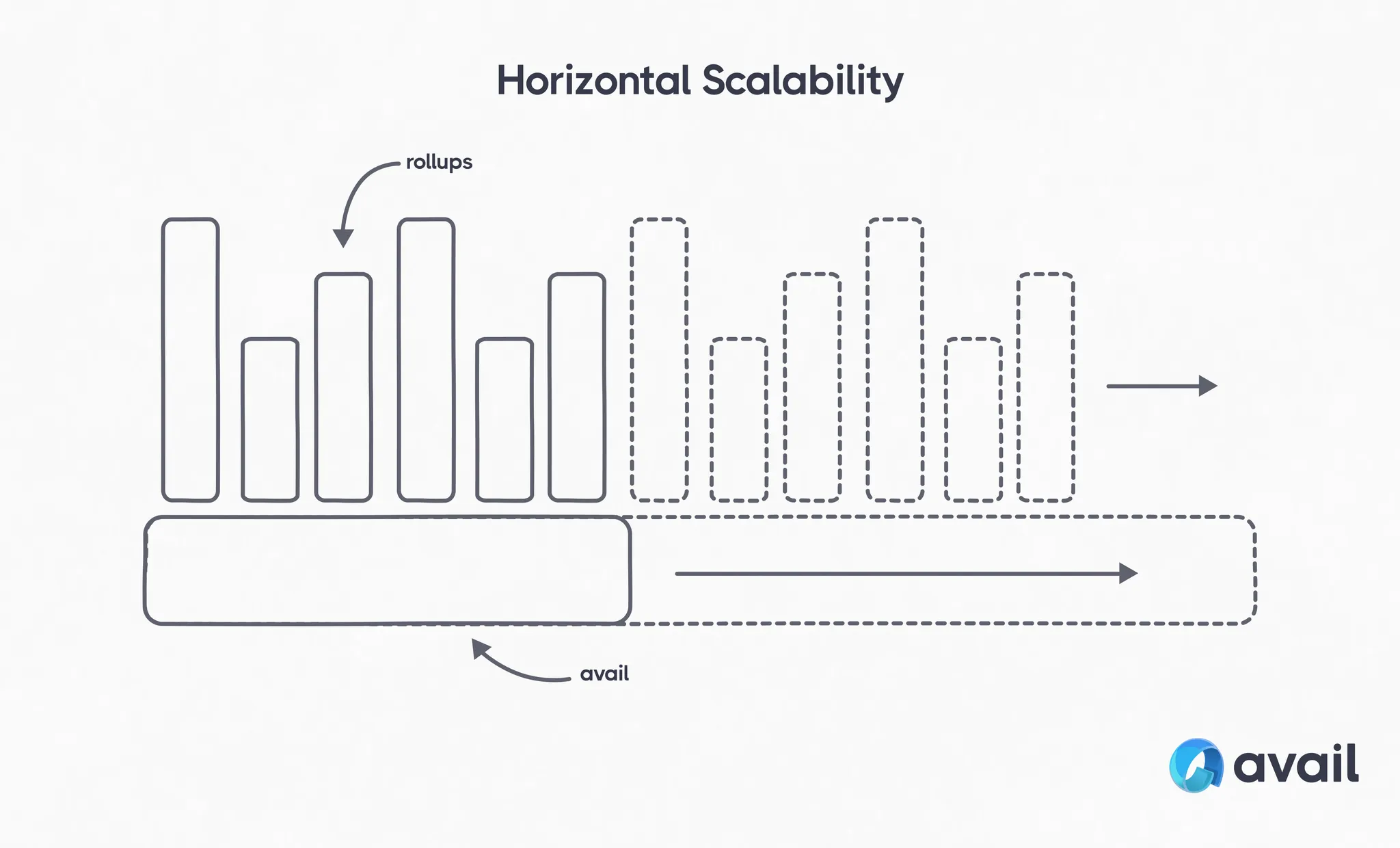

2. A Horizontal Scalable Foundation Solves Fragmentation

When you click on a hyperlink today, you’re not asked to switch networks, you’re simply taken to the next page. While websites are spread across different servers, they’re seamlessly connected through a shared public network. A core architectural principle underpinning this is horizontal scalability.

Optimized for handling transaction data posted en masse from rollups, Avail is building towards supporting crosschain transactions that are as seamless as switching between websites on the public internet, with the ability to easily absorb peak demands.

Avail’s core thesis is based on the assumption that asset tokenization is not only going to happen, but it’s going to require public infrastructure that can scale to support it. By optimizing for rollup adoption today and handling the quick and efficient passing of messages between them, Avail’s public blockchain network is positioned to play a key role in powering the tokenization efforts of millions of organizations around the world.